IRS Taxation matters are critical and time-sensitive. A licensed agent or experienced certified public accountant (CPA) can help you with your tax matter, but it is very crucial to know when it’s time to hire an IRS tax attorney and why you need one. The first step is to contact a tax attorney when you have a tax problem and owe money to the IRS. Complicated issues may arise that you’re CPA or tax preparer might not be able to help you with. Sometimes CPAs and local Tax Prepares will tell you to contact the IRS on your own. Sometimes this is not the right choice and could potentially hurt you more than helping you.

The best way to get your tax problems resolved and explore your tax relief options is to contact a tax attorney near you. Nine times out of ten a tax attorney or tax lawyer is best suited to handle your IRS tax matter depending on your situation. Tax attorneys are more familiar with the complexities of the tax laws and the legalities. Our IRS tax lawyers have all the necessary qualifications and know-how to handle cases with legal consequences. This makes us your best tax defense option when you have tax-related problems.

Benefits of Hiring an IRS Tax Attorney

1. The right tax decisions

A CPA might be good with tax matters but they have limitations, unlike our experienced tax attorney. They have a fantastic knowledge of the different tax laws and programs available to help you discharge debts and eliminate your tax debt. Tax codes and laws have the tendency to change and they are quite complex as well. Our tax attorneys will navigate you through the process of tax resolution.

It is a well-known fact that being under the collections process of the IRS is very risky and a little mistake or advice can cost a lot. So, who more than an IRS attorney is more qualified to help you make the right tax decisions.

2. Lawyer-client confidentiality privilege

When You Should Talk To An IRS Tax Attorney

The minute you know you have an IRS Tax problem it’s in your best interest to speak with one of our tax attorneys immediately. Our goal is to get you the best option for tax debt relief. Our tax attorney understands complex tax audit situations and will represent you before the IRS, negotiate matters on your behalf and also meet required deadlines to avoid more penalties and interest.

Here are some situations when you need to hire an IRS tax attorney to represent you

1. Back Tax and Tax Auditing

Depending on your liability amount the IRS will assign a Revenue Officer to the case. They are often sent to your home or office to ask more questions, that more or less means a formal investigation has been opened. If you are currently in this situation, now is the best time to hire a tax attorney because any information given to the IRS after that would be used against you.

You need a tax debt attorney on your side to represent you before the IRS. Most importantly protecting your assets and rights.

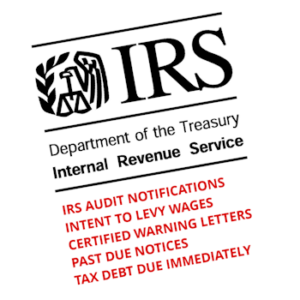

2. Receive a Warning Letters from the IRS or charged for Tax Evasion

Our IRS Tax Attorney will talk to the IRS on your behalf and negotiate a settlement offer. With our experience, we can lower or in some cases even eliminate your tax debt. If you are eventually charged with a crime, we can also represent you in tax court.

The key representation before the IRS Audit and eliminate tax problems. It’s always best to have a tax attorney represent you the minute the IRS informs you of an audit, so we can resolve the issue quickly on your behalf to avoid further issues.

Talk to an IRS Tax Attorney Today

Here are some questions to ask yourself before hiring an IRS tax attorney.

- Do you owe the IRS more than $10,000?

- Do you want to reduce your tax debt?

- Are you currently being audit by the IRS?

- Did you receive any letter from the IRS regarding tax problems?

- Do you have a Revenue Officer?

- Do you have unfilled tax years?

- Are you currently being garnished?

- Did the IRS levy your bank account?

- Do you have a Tax Lien?

If you answered YES to any of the questions above, call us for immediate help. The consultation is FREE! 800-804-2769