Step By Step Extension Instructions

Here are the very simple step-by-step instructions to file for an automatic 6-months extension on your IRS paperwork. Remember that this is an extension on

Here are the very simple step-by-step instructions to file for an automatic 6-months extension on your IRS paperwork. Remember that this is an extension on

The Internal Revenue Service is reminding teachers and other educators planning ahead for 2022 that educators will be able to deduct up to $300 of

It’s time to start making arrangements to file for an automation extension if you’re unable to file your tax return by this year’s April 18

Let’s get down to the nitty-gritty. The IRS does offer payment plans. Before we tell you about the payment plans be sure you discuss your

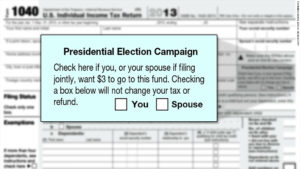

For many taxpayers paying taxes to the IRS can be very frustrating because you may not know where your tax dollars are going and you

The IRS has an appeals process. Here’s how it works. You can use the appeals process if: You received a letter from the IRS explaining

The IRS is understaffed and overworked which is why the IRS is pushing these reminders to speed the processing of tax returns. They’ll also speed

This is the time of year when many consumers find out that they’re a victim of identity theft. And they find out that they’re a

The IRS is very serious about getting its share of profits on virtual currency transactions and it has just posted another reminder to taxpayers about